Taxes are what every American citizen has to pay. It is what the government uses to take care of the country, your roads, your buildings, your police, etc. It is the single largest expense in a person’s lifetime. You will spend more money on taxes than you will spend on housing and food combined. How do you make sure that you do not have more than necessary taken out of your paycheck and, at the same time, do not get penalized?

What is Form W-4 Used For?

Most of us are aware of the fact that a chunk of our paycheck goes to cover taxes. This is known as tax withholding. First, let’s make it clear that taking a part of the employee’s paycheck is what every employer has to do according to the Internal Revenue Service (IRS) requirement. Why? The reason is two-fold.

On one end, you do not end up in a difficult situation at the end of the year, when you owe the IRS thousands of dollars. On the other hand, the government gets paid regularly. That way, it does not have to wait until April 15 the to bring in enough money to pay its bills, such as salaries of federal workers, contractors, and Medicare benefits.

Another question that might arise is, how much exactly should your employer take from your paycheck? This is where Form W-4 comes in, which something that employees fill out on their first day of work. If you did not owe any taxes last year and believe that everything will be the same this year, you also have an option to claim an exemption.

Since the Tax Cuts and Jobs Act several years ago, a new and completely different Form W-4 was presented to the taxpayers in 2020. To avoid surprises when it comes time to file your taxes, if you get a new job or you are already employed and want to make an update, then you need to ensure that your W-4 form is valid and has accurate information. Why?

The W-4 form is how employers know how much income tax employees want to be withheld from their paycheck. The amount you have withheld is almost completely up to you, and you determine how much is going to be withheld by filling out the W-4 Employee’s Withholding Certificate.

This, though, does not mean that you will owe less or more to the IRS. Employees simply tell what deposits they want to make toward their federal tax liability. At the end of the year, when you can most accurately calculate your tax liability, you might need to pay taxes if you did not have enough withdrawn from your paycheck and sent to the IRS. If more that needed was taken out of your paycheck, then the IRS will refund the difference.

How to Read and Fill Out Form W-4

The new version of W-4 makes it simpler for people to come out as a net $0 at year-end instead of either owing taxes or getting a tax return. It no longer has a Personal Allowances Worksheet that people used to determine allowances to optimize the amount of income taxes their employer withheld. Let’s walk through the new process together, step by step, and line by line.

Step 1: Provide Your Information

The first step is relatively simple because you simply need to enter personal information. The most important part you need to get correctly during this step is to check the right box for single or married filing separately, married filing jointly, or head of household.

There have been minor changes to these classifications, so get familiar with your classification before you check any box because different tax rates will apply to each classification. The good news for single filers is that if they have one job and no dependents and other tax situations that need to be taken into account, then they can skip to the last step where the just sign and date the paper.

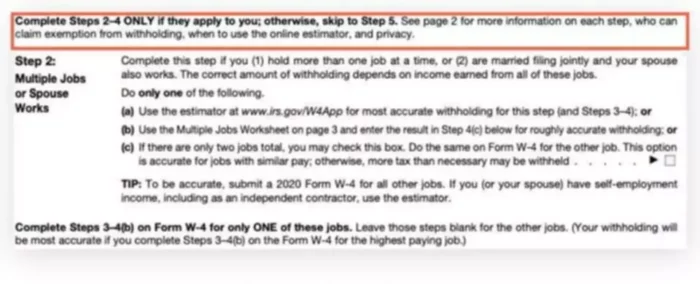

Step 2: Multiple Jobs or a Working Spouse

Step 2 should be completed only by those who hold more than one job at a time or are filing taxes together with a working spouse. Both of these conditions affect tax rates at which you should be withholding your taxes. To make it more clear if your employer does not know that you are actually earning more in total, they will not know that a higher tax rate might be applicable. At the end of the tax year, you will be presented with a tax liability because you did not pay enough. The same goes if you are

married and filing jointly.

a) One of the available options that should give the most precise results is to use the Tax Withholding Estimator. This estimate will need to be included in step four. Independent contractors and self-employed (including if your spouse is self-employed) should choose this option.

b) You can also use a Multiple Jobs Worksheet on the third page of the W-4 form. You can get this worksheet from your employer or download it from the IRS website. To ensure that you get a more accurate withholding, complete this worksheet only for one of your W-4 forms and enter the results only for the highest paying job. You will include the end result in step 4(c).

c) Check this box on the W-4 form for both jobs if you have two jobs with about the same salaries. Thus, if you have two jobs with income that drastically differs or your spouse makes significantly less or more than you, you need to use option a) or b). Otherwise, you will get over-withheld income taxes.

Step 3: If You Have Dependents

If you are married or if you are single with more than one job, complete steps 3 – 4(b) only on the Form W4 of the highest paying job. Do not do steps 3 – 4 (b) on all your W4s, otherwise you will be double-counting these fields.

The most common credits people claim in this section are having children under the age of 17 years (Child Tax Credit), a qualifying relative or dependent. To be able to claim credits, your income should not exceed the specified amount.

The household gets credit for each child and for other dependents, which can include your parents who live with you and other individuals. You can familiarize yourself with the IRS explanation of who is qualified by reading the IRS Publication 501. Overall, this is where you adjust your income to reduce your taxes.

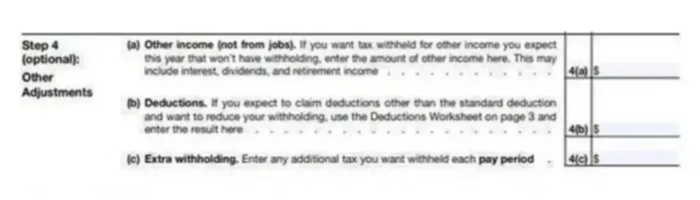

Step 4: Other Adjustments

This is also an optional step. If you want tax withheld from additional income where there are no taxes withheld, note it in step 4(a). This income should be expected from sources other than your job/s this year, such as dividends, interest, capital gains, and retirement income.

If you will have deductions greater than the standard deduction, then this is the time to make that adjustment. Most people will only claim the standard one and can ignore this section. However, if you, for instance, have a large mortgage or a lot of medical expenses that qualify, you are most likely going to claim itemized deductions. In this case, complete Deductions Worksheet from page 3 and add the amount you get under 4(b).

Finally, the results from some of the other calculations you did earlier (if you chose them) will be entered under 4(c). This will include the results from step 2 and any other extra with holdings you would like to be taken out of your paycheck every pay period.

It might seem unreasonable to want to have more taxes withheld from your paycheck; however, it might prevent a situation where you will end up owing taxes and not having money set aside to pay them. This is usually a case if you use Form 1099 to report a large portion of your income, which can come from either being self-employed or receiving income in the form of interest or dividends.

Step 5: Sign and Date Form

This is the final and the easiest step. You will need to sign and date this W-4 form. If the employee will not sign off on this, it is going to default to the single rate. The employer will also fill out their portion of this form and will enter all these numbers into their payroll systems. The payroll systems are getting more and more accurate settings for this now.

When You Need a New W-4

So, who needs to complete this new W-4 form? Everyone who is hired on and after January 1 st , 2020, will need to complete this form. Employers cannot require other employees to complete this new form, but they can suggest updating their W-4 form.

If employees have life events, such as getting married or having children, that change their answers to the W-4 form, they need to update it to reflect these changes. Updating this form is important, so your employer has correct W-4 information, and if you get a tax break, it is reflected in your paychecks.

Special Considerations

If you were unemployed for at least 120 days and then start a job, then you can take advantage of a part-year tax withholding method. To do so, you will need to make a written request to your employer to use this method. This will ensure that you are not overpaying taxes, so your paycheck will not be significantly reduced, and your money kept from you until the tax returns.

The Bottom Line

Filling out the W-4 correctly allows every employee to withhold just enough. Remember, under-withholding can mean that you might have to cover an unexpected liability and possibly incur penalties for underpaying your taxes, neither you want to over-withhold. Your goal is to get it right enough that you do not owe a ton of money, and you do not get a huge return at the end of the year. You do not want the IRS to borrow money from you and not pay you any interest. That money could be invested every month into your retirement or some other investment.

If you have a complicated personal financial situation, it might be more difficult to get every step calculated right and not miss any information, such as income sources or tax credits that you might be eligible for. Thus, we recommend talking to your tax specialist to get some insight on this. If your major life change or find that your business on the side is doing better than expected, adjust W-4 form accordingly before the end of the year.