When starting a business, most entrepreneurs are unfamiliar with many economic concepts and processes. Nevertheless, over time, you have to master this too. After all, business owners are always interested in developing and increasing the income of their company.

One of the key concepts that help to see an objective picture of the state of business operations, assess profitability, and understand how to take a company to the next level is the concept of margin. In this article, we are going to discuss what a margin is, how to calculate sales margin, and how sales margin differs from gross margin.

Definition

Sales margin is an operating performance measure that allows analysts to understand the profitability of each individual activity that generates revenue. This ratio combines sales and distribution expenses with the cost of goods sold, which results in the isolation of all profits from a company’s revenue-generating activities.

When it comes to margins, you will come across gross margin and sales margin. These two terms are very similar and often used almost interchangeably. However, there is a slight difference between these two. First of all, it is worth pointing out that the first is calculated for all the business revenues received and accounts for all costs of goods sold. Sales margin, on the other hand, is used to analyze the margin for just one product or several products for a set period of time.

Formula

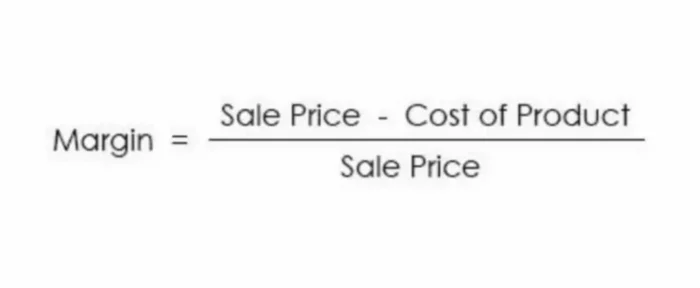

To calculate sales margin, you do not need to do any complicated math. You can see its formula below.

Cost of product is the total costs involved in making a product and getting it ready for sale. So, you would need to include direct and indirect material costs and direct and indirect labor costs for a manufacturing company. If this is a retailer, you would include supply costs, which are kind of like material costs for the manufacturer, direct labor and overhead costs, such as customer service, sales promotions, advertising, sales employee commissions, benefits, travel expenses, payroll expense for sales personnel, distribution costs, and any other expenses related to the sales.

The sales margin is especially valuable when calculated for individual product types since the cost of sales and distribution can vary significantly by product line. This way, managers can calculate the actual margins the business generated in each particular production area. In fact, at the end of the calculations and analysis, it might happen that the company will realize that although some product lines bring in more gross sales, the sales margin for them is lower in comparison to product lines with lower gross sales amount.

When analyzing the sales margin, it is more useful to compare it to the previous periods and see the trend of distribution and sales costs changes in relation to sales volume. In addition, if the business works in a sphere where there are seasonal sales peaks and downtimes, then when looking at the results, it is important to keep this in mind. In such cases, this ratio is either calculated for longer periods of time, e.g. a year, or the margin for the current sales peak period is compared to the margin for the previous sales peak season and so on.

As you might have guessed, everyone is looking for ways to maximize this sales margin. Some do it by reducing their costs, others increase their prices and focus on attracting people to buy their product despite the higher price. Many choose to combine the two to achieve the best possible result in improving the sales margin numbers.

Example

To help you better understand the sales margin concept, let’s look at an example of calculating one for different companies. XYZ Supplies implemented a new sales strategy during the peak sales time. Thus, it wants to calculate if its sales margin increased during the peak three months of operations.

Last year the revenue for notebooks and other paper supplies amounted to $20,000, while the product costs were $8,000. This year, sales rose to $28,000 and the costs also rose to $11,000. To get sales margin for the last year, we would subtract $8,000 from $20,000 to get $12,000. Then, we need to divide $12,000 by $20,000. This gives us a sales margin of 0.6 or 60%.

During the current year the sales margin would be ($28,000 – $11,000) / $28,000. The sales margin we received for this year is 0.607 or 60.7%. The results might have surprised you. It might seem that the new strategy has worked and the sales revenue has increased significantly. At the same time, the rise in costs is not that significant. Yet, we see that the difference in sales margin is less than 1%.

Is this a good result? It might be if in the previous periods the company was not able to improve this product line’s margin or if it is better in comparison to changes in sales margin for other products XYZ Supplies is selling.