Overview

To attract investment, you need to understand what share of the company you are willing to give for a given amount of money. This step is only possible if you calculate the value of your business. Also, more and more often, funds are invested in the business for the purpose of subsequent resale or merger with other organizations for profit.

No matter the reason you want to know the value of your business or business you are looking to invest in, you need to know how to assess the value of a business and use some kind of business valuation formula to get the answer.

The key aspect for evaluating a business is the sphere of operations of the company, as well as its future outlook. It is essential for the buyer of a company to know what dangers may arise after its acquisition. That is why the cost of a liquidated company, for instance, should be 15-25% lower than the price of a successfully running business.

When assessing the value of a company, it is worth paying special attention to its stability in the market, to the stability of its income, as well as to the volume of its profits. This will allow the future owner of the company to actually make a profit after acquiring the company.

To evaluate a business, you can use different approaches. Each of the approaches has assessment methods that differ in the way they collect and analyze information. The choice of method depends on the purpose of the business assessment and the state of the company. In addition, different approaches give us different kinds of value, and each has its own goals and objectives for the valuation.

The choice of a business valuation method directly depends on the purposes for which it is carried out. For the purposes of managing the value of a company, several valuation methods can be used. These indicators cannot be combined. Rather, they are analyzed separately, compared with each other, and serve to make various management decisions.

Keep in mind that for the most correct valuation results, any type of valuation activity should be carried out by professional specialists who have the required level of knowledge and experience. When choosing a specific method(s), the expert bases the choice on the specifics of the enterprise and the market in which it is represented. Next, we will review the purpose and most common business valuation methods.

Company Valuation Purpose

With a valuation report, you don’t have to worry about going cheap when selling a company or investing in a failed project. A company valuation is needed for:

- buying or selling a business and shares in it

- mergers with other companies

- decisions on the issue or sale of securities

- preparation or adjustment of a business plan

- optimization or restructuring of a business

- comparing the investment attractiveness of the project with other options for investing money.

Some buyers purchase a business for re-sale. Basically, the purchase of calculating this number is doing business and making a profit. Therefore, pay attention to the cash flows of your company, they must be stable. This will guarantee the profitability of the organization being sold.

In addition, after getting the valuation results, the owner and management can discover many unexpected and unpleasant facts. For example, we can find out that the assets on the Balance sheet that were considered profitable did not turn out to be so. This will allow you to get rid of such items in a timely manner or take measures to eliminate such a situation. A good example is to lease equipment or building instead of buying and maintaining your own.

When applying for a loan from a bank, a business owner can negotiate completely different, more favorable conditions. This can allow companies to get a large loan amount secured by their own assets. Also, business owners can put forward certain requirements during negotiations with investors when it comes to buying, merging, or issuing securities.

Asset-based valuation

Asset-based valuation is the simplest method. The entire business is made up of a number of assets. We would evaluate each asset separately and then summarize their value. The assets of the enterprise and their wear and tear are taken into account. This adds up to the price of a running business.

The method is suitable for evaluating simple businesses. It is quite difficult to assess intellectual property using this method. In addition, it may be difficult to assess the effectiveness of the use of assets. For example, a business has many assets and the value of the business is high. However, at the same time, the profitability of the assets themselves can be extremely low. Therefore, this method is suitable if you plan to sell the acquired business in parts.

Market Approach

The selling/buying price of a business under conditions of the market competition can be determined using this approach. The market value will be the price of all the assets of the organization, taking into account the income that can be received in the future.

This business value is determined when it is necessary to find out where the organization is in the market for conducting M&A transactions (mergers or acquisitions), selling a business, or adjusting a long-term development strategy. Determination of market value when evaluating a business is based on an in-depth analysis of profits and cash flows.

Discounted Cash Flow Business Valuation Formula

The most important rule in the finance world can be stated as “One dollar today does not equal one dollar tomorrow.” After all, during this period, this dollar can earn interest or, on the contrary, be invested with a certain risk and lost. In order to understand the value of a business today, it is necessary to discount (bring to the present value) the projected or future cash flows.

Discounted cash flow valuation is forecasting the future income of a business. During the valuation, it is also necessary to compare the optimistic forecast with the conservative one. As a result, the enterprise will cost as much as the profit it will bring in the future, taking into account discounting. Discounting approach is not suitable for companies that do not expect to make a lot of money and profits in the coming years. For example, you are developing a complex technological product and it will take more than three years.

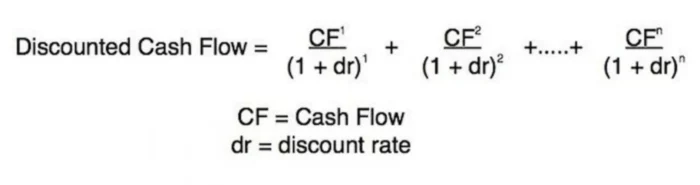

The business valuation formula is relatively simple when using this method. For discounting, you first need to estimate how much approximately you expect to make in the future, i.e. future cash flows of your business. It also takes a lot of time and effort to correctly calculate the discount rate that you will use in your calculation. It can be selected based on the opportunity cost or the cost of financing the investment. Then, you simply use the formula above or an online calculator to input your data and get the required discounted cash flows. The sum of these flows over five years will be the value of the company.

Liquidation method

The business valuation formula using a liquidation formula would be the value of the business in monetary terms minus all costs associated with its sale. Such a value estimate is needed when, due to unforeseen circumstances, it is necessary to close a business as soon as possible. It is important to remember that with an emergency sale of a business, its value becomes lower than the market value.

For instance, Delfa Inc. is closed due to high competition in the market. In this case, according to the latest reports, the price of all the assets is determined. All debts to counterparties and partners, payments to employees, payment of interest, the cost of maintaining equipment in good condition until the moment of sale are deducted from the amount received. Also, do not forget that even during the liquidation process, the company can still make a profit.

As you can see, business valuation is an important tool that management and business owners can use to get the most out of their company.