Most people are confused by bank accounting. We know how a company accounting works because a lot of us have more or less experience with it. Bank accounting is different. At the same time, we are sure you will find that it is very interesting and not that complicated after we look at each financial statement and explain it.

Balance Sheet

The Balance Sheet of a commercial bank is an accounting statement of its assets and liabilities at a particular time. The difference between a bank and a regular business lies in the details that one will find in this statement.

- ASSETS

Assets refer to items from which the bank expects to generate income or through which it tries to protect its interests. They include the following items:

- Cash Balances – there are several cash balances because a portion of total cash is held to ensure a bank has money on hand for customer withdrawals, balances at other banks, etc. This money does not earn any income for the bank, but is the most liquid asset;

- Money at Call or Short Notice – these refer to the short-term (1 to 15 days) loans made by the bank in the money market to meet large payments, unexpected demand for funds, etc. They generate some interest income for the bank and are highly liquid;

- Investments – government and other securities that earn income for banks, but less liquid than cash and similar assets;

- Loans and Advances – these include cash credit and overdraft, purchase and discounting of bills, demand loans, and term loans;

- Other Assets – these can be fixed assets, such as premises for business purposes, furniture, and fixtures.

- LIABILIITES

Liabilities include payments to be made by the bank to shareholders, depositors, or others. They are the sources of funds. They include the following:

- Paid-up Capital – this is what the shareholders gave to the bank, indicating the bank’s liabilities to shareholders;

- Borrowings – these include refinancing received from commercial banks, the federal reserve banks, and other financial institutions;

- Deposits – these can be deposits payable on demand and deposits accepted for a term. They serve as a main source of funds, for which the bank might pay interest depending on deposit conditions;

- Reserves and Surplus – to meet the contingencies constitutes Reserves and Surplus, over the years, the bank accumulates some amount of profits not distributed to the shareholders;

- Other Liabilities – these are liabilities a bank incurs in the course of its business and include interest accrued on deposits an borrowing, but not due yet.

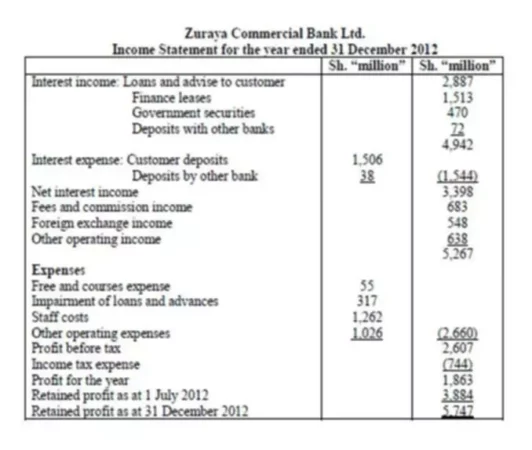

Income Statement

How do banks make money and where are their profits reflected on their financial statements? As with a regular business, you will see it on the Income Statement.

The main income for a bank is Interest, Income arising from Overdrafts, Loans and Advances and Other Lendings, Commissions and Fees arising from Bank Drafts, Standing Orders, Ledger Fees, Bank Transfers, etc. It should be noted that to calculate Net Income from Interest and Commissions and Fees, the bank has to take into account Interest Expenses and Expenses on Commissions and Fees.

Just like a regular business, it has a large list of expenses, including taxes. The general administrative selling and distribution expenses of banks are normally classified under operating expenses and deducted from the gross operating income.

One of the items that sets the bank’s Income Statement apart is the provision for bad and doubtful debts. This is a way for banks to account for loans that they believe they will not be able to collect at all and loans that they hope to collect at least a portion of in the future.

After deducting expenses and other related costs, the bank has Net Profit before Tax just like any other company. There is no special name for the final profits of a bank because banks are companies just like any other company.

Cash Flow Statement

If you look at the Statement of Cash Flows example above, you can see that the basic structure is the same as you would see on standard financial statements. You have Operating Activities, then Investing Activities followed by Financing Activities. The final line will reflect a net increase or decrease in the bank’s cash and cash equivalents. Obviously, the items under each section will be different from what you see in a regular business, but these activities are easy to distinguish and most numbers for this statement will come from the Balance Sheet and the Statement of Profit and Loss.