The debt ratio is an indicator of the financial condition of an enterprise, without which neither managers of organizations, nor owners of companies, nor persons wishing to invest their own funds in any business (e.g. purchase stocks) can do without. So, what does it tell and what formula is used to calculate this ratio? Read this article to find out.

Definition and overview

Analysis of the financial activities of an enterprise allows you to timely track negative trends in the financial situation of the enterprise and, most importantly, take appropriate timely measures to eliminate them. One of the most important sections of the Balance sheet that should be subjected to such analysis is the company’s debt.

The task of the accounting department is to track the dynamics of the organization’s situation and, as a result, to clarify the conditions for effective management of capital turnover. The debt ratio reflects the share of borrowed funds in the structure of the company’s assets. This is a relative indicator and the main financial indicator when studying trends that adversely affect the state of an economic entity.

Purpose

The debt ratio, one of the leverage ratios, is used to achieve the following goals:

- Determination of the ratio of all received loans to the volume of total assets – used by managers and legal entities of organizations.

- Calculation of the potential profitability of the project and possible dividends – used by investors.

- Determination of the effectiveness of management decisions in the reporting period – used by managers and legal entities of organizations.

- Assessment of possible risks before making decisions regarding issuing loans – used by lenders.

This ratio is calculated on the basis of data that appear in the financial records and makes it possible to compare not only specific companies but also sectors of the national economy. With the help of this indicator, financial analysts are able to calculate the efficiency of the enterprise in various reporting periods, compare the results of the activities of legal entities with the average indicators for a particular industry.

Calculation of the ratio

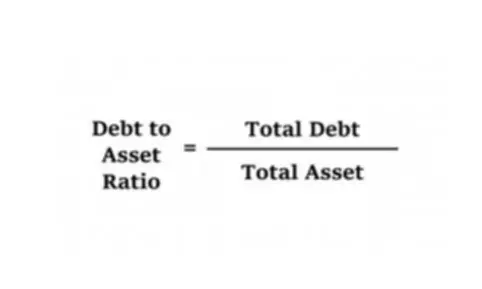

The formula for calculating the financial ratio looks like this:

In fact, the formula for calculating the debt ratio is the ratio of the volume of the company’s debt to its assets. The indicator is calculated on the values of the data on the current situation of the company presented in the main document – the Balance sheet. However, depending on the goal pursued by the analyst, the approach to interpretation will differ, and, respectively, the sources of information will also differ.

Interpretation of calculations

A standard value of the debt ratio, according to the above formula, can fluctuate in the range from 0 to 1.

- A ratio close to 0 informs about a stable financial condition of the enterprise and indicates that the amount of the organization’s debt is significantly less than the amount of its assets.

- A debt ratio of 0.5 is considered acceptable, although not for all economic areas.

- A debt ratio close to 1 indicates a large dependence of production on its creditors. This financial situation can lead to a lack of working capital and an emergency short-term loan.

- A ratio of 1 shows the financial insolvency of the company.