Accounts Payable

Accounts payable is a bookkeeping account you will see in most businesses. It means that the company is buying something from suppliers or receiving services from other entities, but it does not pay for anything until sometime later agreed upon by both parties.

If the business can get something today and not have to pay for it for a whole month or two, it allows businesses to increase their cash flow in the short. The money it did not pay right ways serves as a kind of power bank for the business for whatever it needs in the short-run (until it actually has to pay the money).

Of course, nothing comes without a downside. There are actually a few downsides to not paying the bill/invoice right away. First of all, the bookkeeper will need to spend more time tracking the outstanding payments and making sure they are paid on time. This means some extra labor costs. Even if you use an app or software that automates such payments for you, the business still incurs costs associated with using such software.

If for whatever reason the company missed the deadline for invoice payment, the supplier or vendor can charge late payment fees and even stop working with the business altogether. Finally, if the company postpones the payment, it means that if there were some possible discounts for businesses who pay early, this company will lose the money it could have potentially saved.

Definition of DPO

Every business owner knows that cash is one of the most important assets it has. Thus, management and business owners have to understand how to increase that cash. There are various ways to achieve this, including increasing profit and collecting money from buyers sooner. One of the ways to do it is by simply using a tactic known as Days Payable Outstanding (DPO).

How long does it take your business to pay your vendors? The DPO provides an answer to this question. The ratio shows how well a company’s cash outflows are being managed. If you get a relatively high number of days, it means that it is able to save money for a longer period, which can allow the use of these funds more efficiently. Knowing days payable outstanding (DPO) will help a company better manage its cash flow.

Formula

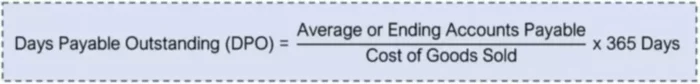

As we just reviewed, DPO means how long it takes a company to pay off a debt to its supplier. The formula for calculating this financial measurement.

As you can see you will need to know the balance of accounts payable, which is an amount due to the company’s suppliers for goods and services received and for which it has yet to pay. The COGS can also be found in the bookkeeping records or taken from the financial reports. Typically, this measurement is calculated for days, so you would divide by 360 days. However, you can also adjust the formula to get measurements for a quarter or month.

Interpretation

The number of DPO is a critical component of the cash conversion cycle, which is used to determine how long cash is tied to working capital. Companies with extremely high DPOs can result in a negative cash conversion cycle. When analyzing along with the cash cycle, the management can see how much time (in days) elapses between paying cash to the supplier and receiving money from the buyer.

This could have happened as a result of great relationships with suppliers. Extremely high DPOs could potentially reveal liquidity problems or long-term lending conditions that favor a company. The suppliers are often not that happy if a business takes a long time to pay its debt. In such cases, they raise prices, tighten terms, or simply choose not to do business with a particular company.

For some companies, it takes less time to make the payments when compared to competitors. While it might not be so good at managing cash, some vendors offer discount terms for early prepayment such as 1/10, net 30 (1% discount if paid within 10 days instead of within 30 days), or other options such as 3/14, net 120 (3% discount if paid within 14 days instead of within 120 days). Since this is an opportunity for a business to save money, if there are invoices with such conditions, many companies take advantage of the discounts and have lower DPOs.

Having fewer days payable outstanding (DPO) in comparison to other businesses typically means that suppliers are giving your competitors better terms, so they can keep their money in-house longer. However, it can point to issues with bills repayment. As you can see, a company should find a balance between preserving the cash and having better operating cash flows and short-term investment abilities, and keeping the suppliers and vendors happy.

Example

Let’s look at how Amazon manages their days payable outstanding. If you look up its Income Statement and Balance Sheet for the year 2020, you will see that its Cost of Revenue was $291,824,000 thousand and Accounts Payable was $72,539,000 thousand. With both of those pieces of data, we can plug into a formula presented above.

DPO = $72,539,000 thousand / $291,824,000 thousand x 360 days

DPO = 89.47 days

So, is this a good indicator? How do we evaluate the result of our calculation? Well, we would need to calculate the same ratios for its peers in the same industry. We can also look at the change over time. Let’s compute how long it took Amazon to pay its suppliers and other parties in 2019.

DPO = $47,183,000 thousand / $205,768,000 thousand x 360 days

DPO = 82.55 days

As you can see, although it took slightly more time for Amazon to repay its obligations, the difference is not huge. The slightly longer period might be a sign of better cash flow management, although that would need further evaluation. eBay is another ecommerce platform that is very similar to Amazon and is one of its main competitors. Let’s calculate the same measurements for this online seller and compare both.

The Balance Sheet of eBay company shows $332,000 thousand under Accounts Payable in 2020 and $270,000 thousand in 2019. Its Cost of Revenue was $2,473,000 thousand in 2020 and $2,508,000 thousand in 2019.

DPO = $332,000 thousand / $2,473,000 thousand x 360 days

DPO = 48.33 days in 2020

DPO = $270,000 thousand / $2,508,000 thousand x 360 days

DPO = 38.76 days in 2019

Our calculations show that Amazon keeps its cash working for the business for almost twice as long as eBay does. This can be a sign that Amazon has better cash flow management and credit terms. However, it might also point to an inability to pay the bills on time. eBay pays its bills and creditors relatively quickly. At the same time, we can see an increase in the DPO numbers for both companies. Further analysis would need to be made to see if the companies are struggling to pay their obligations or get better at managing their cash flow cycle.