Use of Control Accounts

A control account summarizes a set of subsidiary accounts. Large businesses use it to minimize the summary postings in the general ledger. Instead, enterprises record all the transaction details in a separate subsidiary ledger. Such actions mean that there is no need to reconcile and extract individual accounts to get account information because the company can refer to the control account balance.

Advantages of Control Accounts

Why use the control accounts? Here are some reasons to consider:

- Provides a checking mechanism to detect errors and fraud at an early stage;

- Removes bulky details from the general ledger;

- Larger companies can set up accounting departments for specific areas;

- Trial balance figures provide a summary of totals, rather than individual accounts;

- Minimize the likelihood of fraud because different staff independently maintains control account records and subsidiary ledger.

Control Account and the Double Entry System

Businesses can use control accounts in two different ways:

- They can be an integral part of a double-entry system. Businesses use General ledger to keep the debtors and creditors control accounts. They use personal accounts as subsidiary records for analysis only, and the Sales and Purchases Ledgers are memorandum books.

- Businesses can also use control accounts to extract information from them. In this case, the subsidiary ledgers become a part of the double-entry system.

Posting of Control Accounts

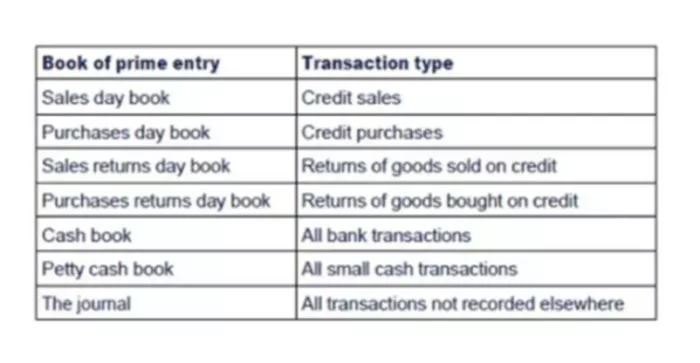

In the illustration below, you can see a Book of Prime Entries, which serves as a source of information for the control accounts.

Control Account Posting Example

Let’s assume that the control accounts form part of the double-entry posting. For instance, if we take accounts payable control account and purchases ledger account, the accountant will do control account posting as follows:

- The accountant records details of each purchase from source documents into the book of Prime Entries, namely the Purchases Day Book. He will then total the entries in the Purchases Day Book.

- To keep track of every purchase, the accountant also makes entries for each supplier in the accounts payable subsidiary ledger. He creates separate accounts for each supplier.

- The accountant records the total purchases amount in the general ledger by debiting the Purchases account and crediting the Accounts Payable control account.

- The accountant then checks that the totals in the Accounts Payable control account and the individual supplier accounts in the subsidiary ledger are equal.

What are the Main Control Accounts?

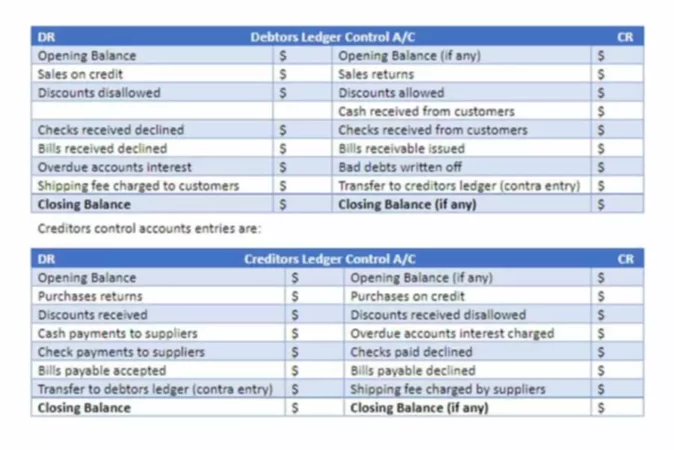

Debtors control accounts entries are:

Sectional Balancing System

Under the self-balancing system, all three ledgers, including the main ledger, are independently self-balanced. When only a section of the group of the ledgers is balanced, we refer to it as sectional balancing. Under sectional balancing, only the general ledger is self-balancing. Here, control accounts are only prepared in general ledger, which has total debtors accounts and whole creditors account. The double entry is completed only in general ledger in respect of total debtors and total creditors accounts. The accounts of individual trade debtors and trade creditors are posted without completing the double entry.