Many people consider paying bills every month an evil, but a necessary one, so they make the most of it by creating a monthly ritual. This is not a bad idea at all, but what if you do not find time for the ritual one month or your monthly schedule gets changed by holidays, travel, or work deadline?

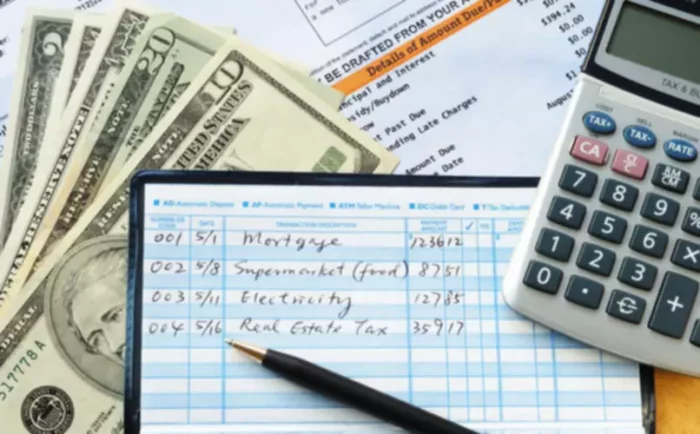

Keeping track of all the small and large bill payments can be very complicated and time-consuming. After all, individuals and especially business owners have a lot going on in their life. Moreover, if you do happen to forget to pay a bill on time, you might incur late fees, other additional costs, and a negative credit score, which no one wants. The last thing you want to worry about is whether your bills are getting paid.

What is Bill Payment Automation?

Putting off bill pay, even for a week, can bring many negative consequences. Fortunately, there is a reliable and easy way to get out of this monthly rut – by automating your finances. Automatic bill pay is essentially allowing whoever you owe money to either get direct access to bank account or to debit or credit card you specify to pay your bills without you actually having to do anything.

The bill payment is done automatically on a pre-set date and for the amount you specify ahead. For example, it might be your utilities, cell phone service or your credit card company pulling from your bank account.

Bill Pay Automation Setup

You can look into the bill payment system at your current bank. Signing up for your bank’s bill pay system is best for bills that are the same amount each month. There may be a monthly fee for this service, but it will be offset by a reduced need to buy checks and it pays for itself if your current bill paying methods sometimes results in late fees or increased interest rates.

Consider using a current credit card. You can ask your payees, your goods and service providers to automatically charge the credit card. It is a good option if the amount is variable each month. Of course, it works best if you do not forget to pay the credit card bill monthly. If some payees can pull or transfer payments right from bank account. This is typically possible between a financial institution, such as bank and credit card company.

There is also payment automation software designed to help businesses of all sizes make and receive all types of payments, including payroll and supplier payments. It helps to reduce risk with electronic validation, reduce time by automating everything, and increase productivity by focusing on more important things.

Pros and Cons of Automatic Bill Payments

There are advantages as well as disadvantages to having your bill payments automated. Let’s review the pros first.

Pros:

- No late fees. The biggest advantage is that your bills get paid and they get paid on time, so you do not have to worry about there being any possibility of late fees or anyone coming after you for a payment that you forgot to make.

- Your credit score might improve. For many people, this also helps to rebuild their credit history. These individuals can be sure that bills get paid on time every month and they do not end up in a hole again and can climb out of it faster.

- It is obviously easy and convenient. You do not have to stress about the bill. You do not have to worry about sending your payments in by mail and a heavy load is taken off of your mind. It is comforting to know your bills will be handled each month with a minimal amount of effort on your part.

Cons:

- Budgeting. The main disadvantage of this automation is that you do not think and properly evaluate your spending habits and trends. It is also harder to notice that some bills have gone up and new charges added, or that you are continuing to pay for a service or product that you might no longer need.

- Insufficient funds. If your balance is not high enough and you did not track it very well, you could have someone try to take the money for covering the bill out of your bank account, and due to the insufficient funds, your bank will charge undesired fees and you will incur late fees from the company you owe money to.

Money can be stolen. There is also a possibility that the company you allow to take money automatically is hacked and someone can get into your bank account and steal your money. There will be an unnecessary hassle to recover that money.