To improve the efficiency of using the company’s own funds, timely analysis of performance indicators, including the calculation of asset turnover, is required. In the article, we will tell you how to correctly calculate the asset turnover ratio, explain what the values mean, calculate the indicator using a specific example.

Meaning

Asset turnover ratio is an indicator of business activity, which reflects the number of complete product circulation cycles for the period under review. The asset turnover ratio makes it possible to assess the efficiency of using all assets of an enterprise, regardless of the source of their formation. The financial condition of the enterprise, its solvency, and liquidity directly depend on the rate of turnover of the invested funds.

The determination of the resource usage efficiency clearly shows how many dollars of profit the company receives from each dollar invested in assets. This helps not only managers to see if their business strategy is working as intended, but also allows investors to see which business will generate more profit for them. However, even if one company’s asset turnover ratio is significantly higher, this is just one criteria and investors have to analyze many other factors.

Although this ratio is very valuable, it has its limitations. Since the ratio uses the total assets in its calculation, it is important to further evaluate what caused the changes in the ratio. Is it an increase or decrease in total assets? Maybe there is a change in the composition of the total assets?

To better understand why the components of this ratio are changing, it is recommended to also look at the management plans with regards to an increase or decrease in property, plant, and equipment. Alternatively, a change in sales revenue could also skew the number one way or the other.

Calculation

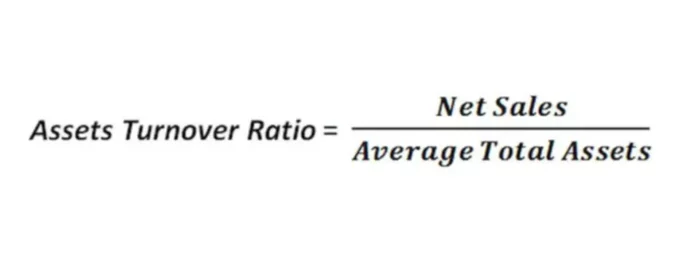

To calculate this financial ratio, you would need some accounting data from the main forms of reporting, namely the Balance sheet and the report on the financial results of the company. The exact formula can be seen above.

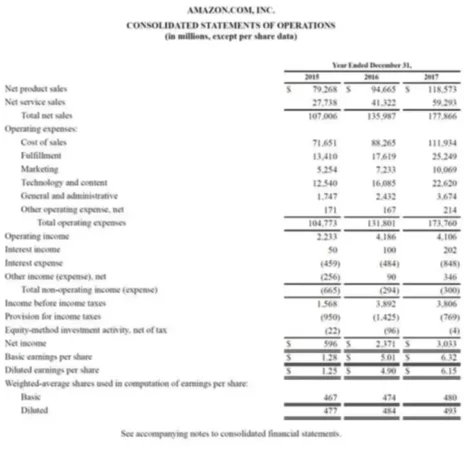

Let’s consider how to calculate this financial ratio using a specific example. We use the reporting forms of Amazon for 2017. The first form is the Income Statement, where we can see that the total net sales in 2017 were $177,866 million.

The other financial report we need is the Balance sheet, which we are going to use for computing the average value of assets. To do so, you would sum up the total assets for two years and divide in half: ($83,402 + $131,310)/2 = $107,356 million. Now, divide $177,866 million by $107,356 million. According to the conditions of our example, it turns out that one dollar of the organization’s own funds accounts for 1.66 dollars of revenue. Is it good or bad? Let’s see how this ratio is analyzed in the financial world.

Analysis

Let’s say the asset turnover ratio of the enterprise is calculated. Now let’s figure out what it means. There is no specific standard for turnover indicators since they depend on the industry characteristics and the sphere in which the company operates. In capital-intensive industries, asset turnover will be lower than in trade or services. Thus, it makes sense to consider this indicator in dynamics, as well as in comparison with the values of direct competitors.

This is the business activity ratio. Consequently, the higher the coefficient, the higher the profitability of the enterprise. However, the value should be calculated over time, that is, in comparison with several reporting periods. This approach will allow you to analyze in detail the growth or decline in turnover.

A positive trend is an increase in the value of the asset turnover ratio in dynamics, and its higher value relative to competitors indicates that the company uses its limited resources more efficiently. Low turnover may indicate insufficient efficiency in the use of assets. In addition, the company might have made less in sales revenue due to a decrease in the number of goods or services sold, and it is also possible that prices for goods or services have dropped due to decreased demand.

When calculating the ratio, it is necessary to take into account the structure of assets. For instance, a low indicator (up to one) can be caused by an increase in inventories, receivables, or property of the enterprise in the reporting period. For example, the organization plans to expand production, and for this, machines, equipment, materials other capital goods are purchased.

Timely analysis of this ratio allows you to obtain reliable information about the financial condition of the organization and indicators of profitability. If deviations or a decrease in value are detected, the management of the enterprise should make appropriate management decisions. If the value of the indicator is relatively low, then it is advisable to take the following steps to improve the ratio:

- optimize the amount of assets by selling part of unused non-current assets (if the increase in workload is not planned)

- reduce the amount of inventories (if their volume is excessive)

- improve the receivable turnover, etc.

Increasing the company’s revenue is also one of the ways to increase asset turnover.