The accounting transaction analysis is the process of translating the business activities and events that have a measurable effect on the accounting equation into the accounting language and writing it in the accounting books. This is the first stage in the accounting cycle, which is the foundation of accounting, regardless of the accounting type you are interested in. Businesses analyze to ensure that the balance sheet equation stays in balance after each transaction is completed.

Six Steps of Accounting Transaction Analysis

1. Determine if the event is an accounting transaction

You first need to determine whether this transaction is a business nature transaction. An accounting also transaction has to involve a monetary amount. So if the company signed a rental contract, there is no accounting transaction. However, if it makes a payment under this contract, it will be an accounting transaction because it has a monetary amount that the company will need to record. Other examples include a purchase of equipment, sale of products, and salary payments.

2. Identify what accounts it affects

Your next step is to identify which accounts the transaction will affect. For example, Ellen invested $38,000 in cash and a used truck with a market value of $8,500 in the business in exchange for the company’s common stock. The cash and truck invested will be assets for that business, recorded under Cash account and Truck account. In exchange for that investment, Ellen will get common stock, so it will also affect the Common Stock account.

3. Determine what type of accounts they are

Every transaction leads to a measurable change in the accounting equation. Knowing whether the account belongs to assets, liabilities, or equity will allow you to determine whether the account will have a debit or credit normal balance. In the example above, we already decided that two accounts will be Asset accounts, and the Common Stock account is the Owner’s Equity type account.

4. Determine which accounts are going up or down

A business records a transaction with an entry that has a debit and credit effect. This double-entry procedure keeps the accounting equation in balance. So, when Ellen invested cash, the cash and truck accounts will increase because the company will now have more money, and it now has a truck. The Common Stock account will also increase.

5. Apply the rules of debits and credits to these accounts

One has to record each business transaction in two or more related but opposite accounts. We debit one account and credit the other Account in the same transaction amount. Accounts on the left side increase with a debit entry and decrease with a credit entry while accounts on the rise in the right side with a credit entry and decrease with a debit. So, if the Cash and Truck accounts will increase, and it is an asset account, the business will debit it. The Common Stock account is the Equity account, which increases with a credit entry.

6. Find the transaction amount to be entered into each account

Your final step would be to determine the amount of the transaction from the business records, such as receipts, invoices, and bank statements.

Accounting Transaction Analysis Table

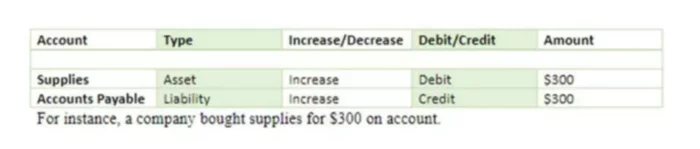

When going through the six steps of the accounting analysis, it is much easier to analyze by filling out an accounting transaction analysis table, such as one below. Let’s go over the example transaction, explaining it step by step and filling the table.

- This is an accounting transaction because it involves a monetary amount and is a business activity.

- The business bought supplies so that it will involve Supplies account. Since it purchased them on account and not with cash, it will use the Account Payable account.

- Supplies are an asset the company acquired. Accounts Payable is a liabilities account because the company still owes money for the amounts it purchased.

- Supplies’ account is increasing because the company has more amounts after this transaction than before. Accounts Payable is also growing because it owes more money than it did before the transaction.

- Supplies (asset) is debited to increase it. Accounts Payable (liability) is credited to enlarge it.

- The company will record $300 for each account as the transaction amount.

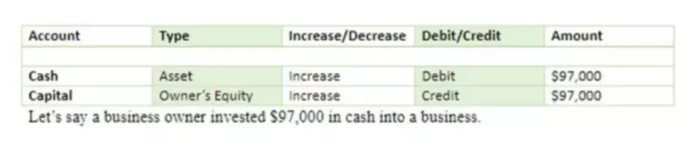

Injection of Capital Transaction Example

Let’s review another example and use the table to summarize our analysis.

- This is an accounting transaction because it involves a monetary amount and is a business activity.

- The two accounts that will be used to record this transaction are Cash and Capital.

- The Cash account is an asset type account, while the Capital is the owner’s equity.

- Both accounts are going up because now there is more money, and the owner made a contribution.

- To increase the Cash (asset), the company will debit it, and to increase Capital (owner’s equity), it will credit it.

- Both accounts will increase by $97,000.